Here are some more reasons you might use the DCF: A healthy DCF is a good sign for both of those. Lenders want to make sure they’ll get paid, and investors want to make money from their investment. Like other accounting metrics, lenders and investors may also look at discounted cash flow to determine the financial viability of a business. On the flip side, if you pay more than the DCF, you’ll lose money-a sign of a bad investment. In fact, this is the most common use case for the DCF calculation.įor example, if you pay a price lower than the DCF value, you’ll generate a positive return on investment (ROI) from your investment. It can also indicate whether an investment is worth making or not. The discounted cash flow formula tells you more than just the future value and cash flow of a company. What is the discounted cash flow (DCF) formula used for? In other words, the earlier you receive money, the more it’s worth. Time value of money (TVM) is the concept that the cash available to a business today is of greater value than that same number in future accounting periods. The DCF can help you make important business decisions, and may be of interest to any investors you have.You need to determine the discount rate to find the present value of projected cash flows.DCF helps you estimate the value of your business based on future cash flows.

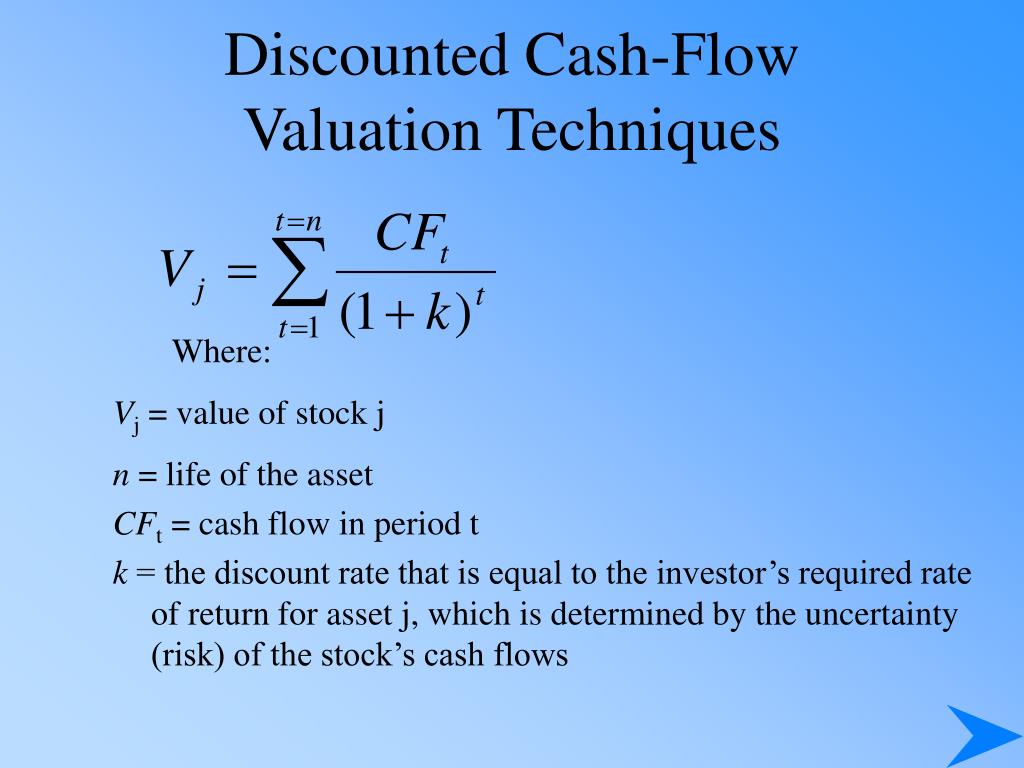

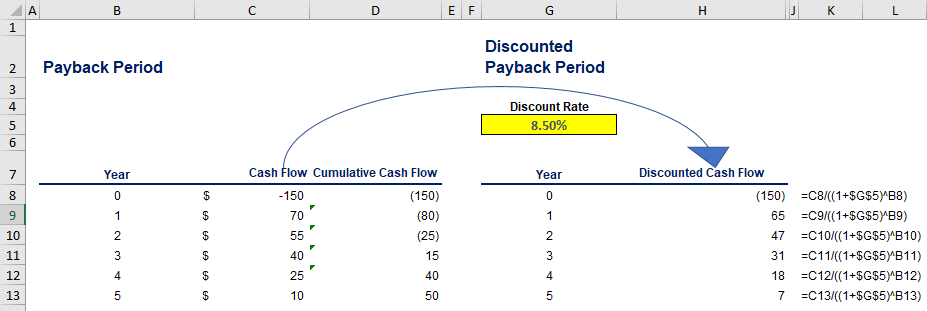

Key takeaways: Discounted cash flow formula This rate is typically based on the weighted average cost of capital (WACC), which is the average cost the company pays for capital to finance assets, whether from selling equity or borrowing money. To do so, the calculation applies a discounted rate per accounting period. When you calculate DCF, you look at the current value of projected cash flow. That's why your grandpa can talk about going to the movies for $0.50 “back in the day,” while it cost you $18 last weekend. If you have $10,000 today, it’s going to be worth a different amount 100 years from now. Thanks to inflation, the value of a dollar changes every year ( sigh). Simple so far, but here’s where it gets a little tricky: that amount of projected cash flow isn’t equal to the same amount of cash today. For example, discounted cash flow can give you insight into whether you can afford to make a larger purchase or investment now and be able to pay it off later. These cash flow projections give a forward-looking view into a business’s cash flow. What is discounted cash flow (DCF)?ĭiscounted cash flow is a measure of anticipated cash flow. You’ll have to do some research to determine the appropriate discount rate for your calculation-it shouldn’t be lower than the inflation rate. The discount rate is used to find the present value of future cash flows. Time periods can be years, quarters, months, etc. Cash flow 2: Cash flow for the second year. Cash flow 1: Cash flow for the first year. But we will focus on the net cash flow which is the net of inflows and outflows.

Cash flow refers to the money moving in and out of your business. DCF = + + Ĭash flow: Cash flow for the given year.

0 kommentar(er)

0 kommentar(er)